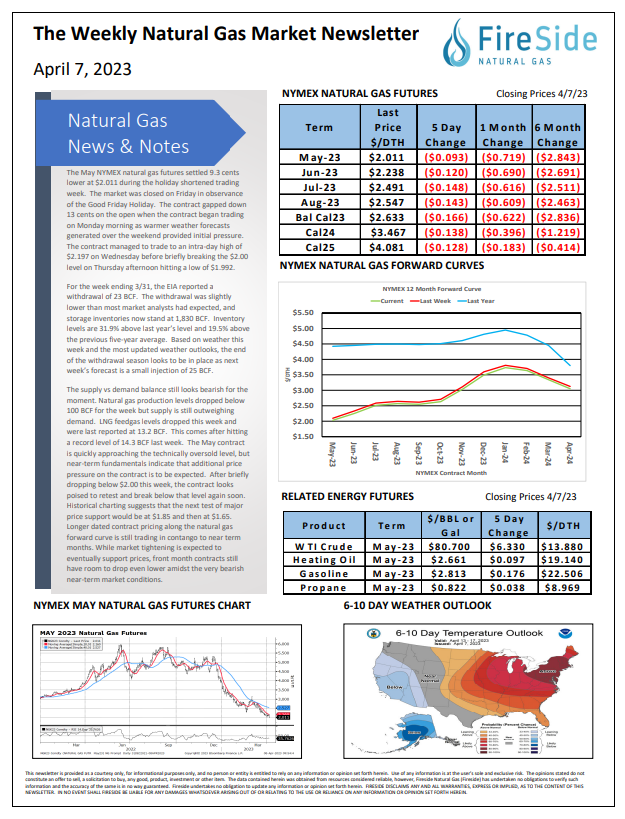

Weekly Natural Gas Market Newsletter April 10th, 2023

The May NYMEX natural gas futures settled 9.3 cents lower at $2.011 during the holiday shortened trading week. The market was closed on Friday in observance of the Good Friday Holiday. The contract gapped down 13 cents on the open when the contract began trading on Monday morning as warmer weather forecasts generated over the weekend provided initial pressure. The contract managed to trade to an intra‐day high of $2.197 on Wednesday before briefly breaking the $2.00 level on Thursday afternoon hitting a low of $1.992.

For the week ending 3/31, the EIA reported a withdrawal of 23 BCF. The withdrawal was slightly lower than most market analysts had expected, and storage inventories now stand at 1,830 BCF. Inventory levels are 31.9% above last year's level and 19.5% above the previous five‐year average. Based on weather this week and the most updated weather outlooks, the end of the withdrawal season looks to be in place as next week's forecast is a small injection of 25 BCF.

The supply vs demand balance still looks bearish for the

moment. Natural gas production levels dropped below

100 BCF for the week but supply is still outweighing

demand. LNG feed gas levels dropped this week and

were last reported at 13.2 BCF. This comes after hitting

a record level of 14.3 BCF last week. The May contract

is quickly approaching the technically oversold level, but

near‐term fundamentals indicate that additional price

pressure on the contract is to be expected. After briefly

dropping below $2.00 this week, the contract looks

poised to retest and break below that level again soon.

Historical charting suggests that the next test of major

price support would be at $1.85 and then at $1.65.

Longer dated contract pricing along the natural gas

forward curve is still trading in contango to near term

months. While market tightening is expected to

eventually support prices, front month contracts still

have room to drop even lower amidst the very bearish

near‐term market conditions.