The Monthly Natural Gas Market Newsletter - September 2021

FireSide Natural Gas Monthly Report

Natural Gas Prices

NYMEX SEPTEMBER 2021

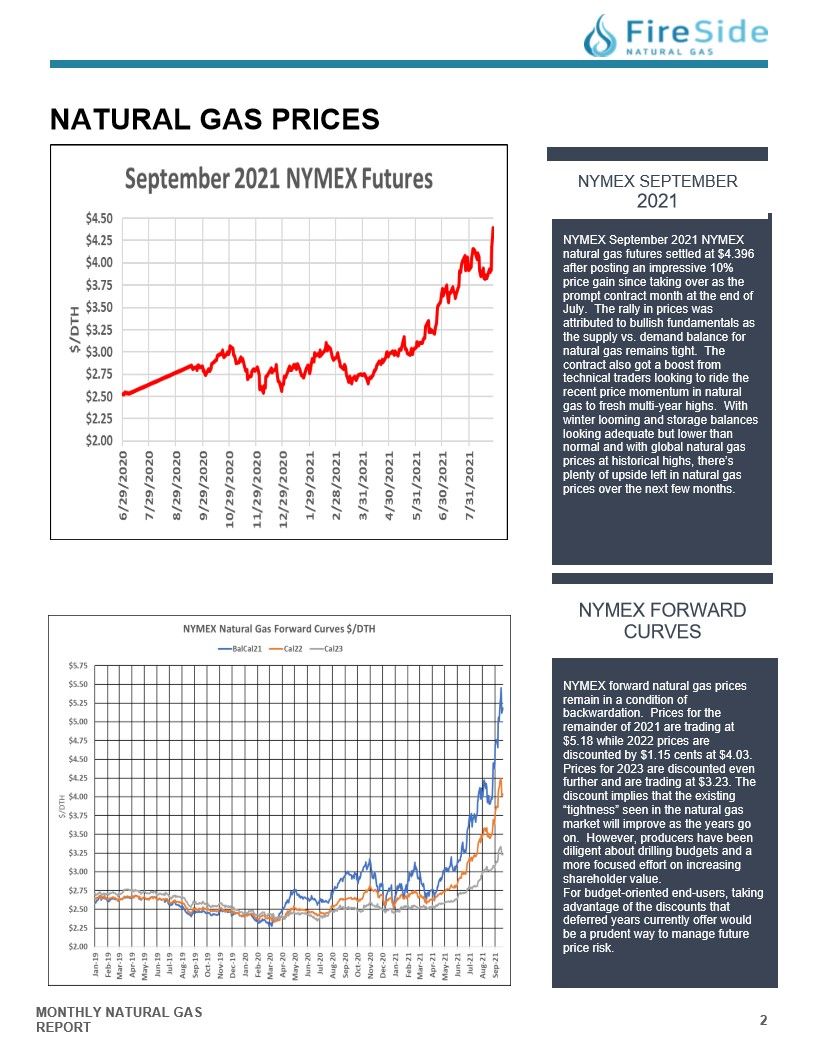

NYMEX September 2021 NYMEX

natural gas futures settled at $4.396

after posting an impressive 10%

price gain since taking over as the

prompt contract month at the end of

July. The rally in prices was

attributed to bullish fundamentals as

the supply vs. demand balance for

natural gas remains tight. The

contract also got a boost from

technical traders looking to ride the

recent price momentum in natural

gas to fresh multi-year highs. With

winter looming and storage balances

looking adequate but lower than

normal and with global natural gas

prices at historical highs, there's

plenty of upside left in natural gas

prices over the next few months.

NYMEX FORWARD CURVES

NYMEX forward natural gas prices

remain in a condition of

backwardation. Prices for the

remainder of 2021 are trading at

$5.18 while 2022 prices are

discounted by $1.15 cents at $4.03.

Prices for 2023 are discounted even

further and are trading at $3.23. The

discount implies that the existing

"tightness" seen in the natural gas

market will improve as the years go

on. However, producers have been

diligent about drilling budgets and a

more focused effort on increasing

shareholder value.

For budget-oriented end-users, taking

advantage of the discounts that

deferred years currently offer would

be a prudent way to manage future

price risk.

NATURAL GAS SUPPLY - US DAILY PRODUCTION

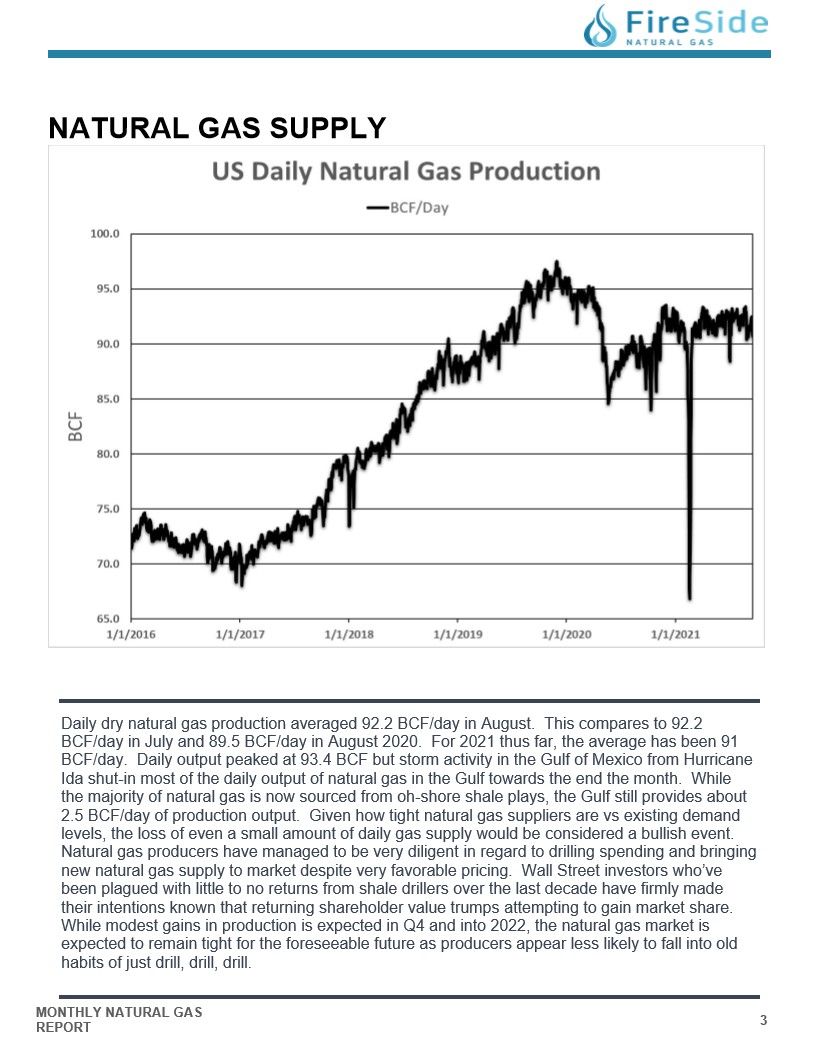

Daily dry natural gas production averaged 92.2 BCF/day in August. This compares to 92.2

BCF/day in July and 89.5 BCF/day in August 2020. For 2021 thus far, the average has been 91

BCF/day. Daily output peaked at 93.4 BCF but storm activity in the Gulf of Mexico from Hurricane

Ida shut-in most of the daily output of natural gas in the Gulf towards the end the month. While

the majority of natural gas is now sourced from oh-shore shale plays, the Gulf still provides about

2.5 BCF/day of production output. Given how tight natural gas suppliers are vs existing demand

levels, the loss of even a small amount of daily gas supply would be considered a bullish event.

Natural gas producers have managed to be very diligent in regard to drilling spending and bringing

new natural gas supply to market despite very favorable pricing. Wall Street investors who've

been plagued with little to no returns from shale drillers over the last decade have firmly made

their intentions known that returning shareholder value trumps attempting to gain market share.

While modest gains in production is expected in Q4 and into 2022, the natural gas market is

expected to remain tight for the foreseeable future as producers appear less likely to fall into old

habits of just drill, drill, drill.

NATURAL GAS DEMAND SECTOR FOCUS - ELECTRICITY GENERATION

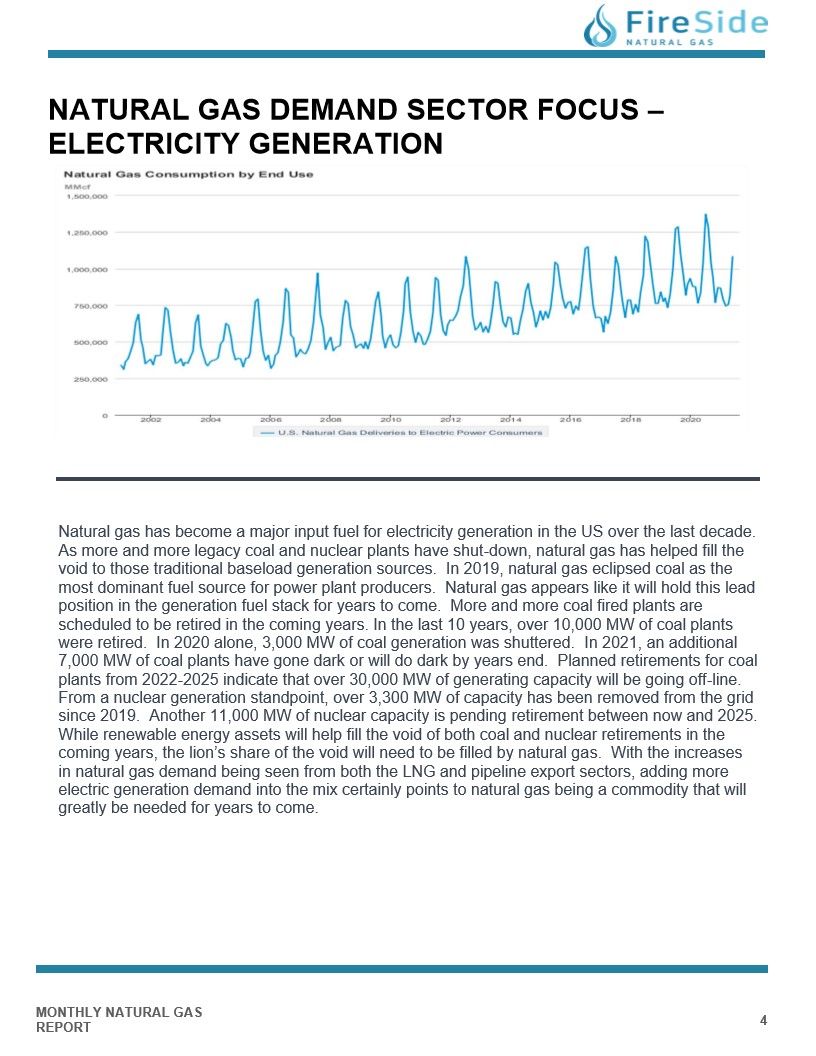

Natural gas has become a major input fuel for electricity generation in the US over the last decade.

As more and more legacy coal and nuclear plants have shut-down, natural gas has helped fill the

void to those traditional baseload generation sources. In 2019, natural gas eclipsed coal as the

most dominant fuel source for power plant producers. Natural gas appears like it will hold this lead

position in the generation fuel stack for years to come. More and more coal fired plants are

scheduled to be retired in the coming years. In the last 10 years, over 10,000 MW of coal plants

were retired. In 2020 alone, 3,000 MW of coal generation was shuttered. In 2021, an additional

7,000 MW of coal plants have gone dark or will do dark by years end. Planned retirements for coal

plants from 2022-2025 indicate that over 30,000 MW of generating capacity will be going off-line.

From a nuclear generation standpoint, over 3,300 MW of capacity has been removed from the grid

since 2019. Another 11,000 MW of nuclear capacity is pending retirement between now and 2025.

While renewable energy assets will help fill the void of both coal and nuclear retirements in the

coming years, the lion's share of the void will need to be filled by natural gas. With the increases

in natural gas demand being seen from both the LNG and pipeline export sectors, adding more

electric generation demand into the mix certainly points to natural gas being a commodity that will

greatly be needed for years to come.

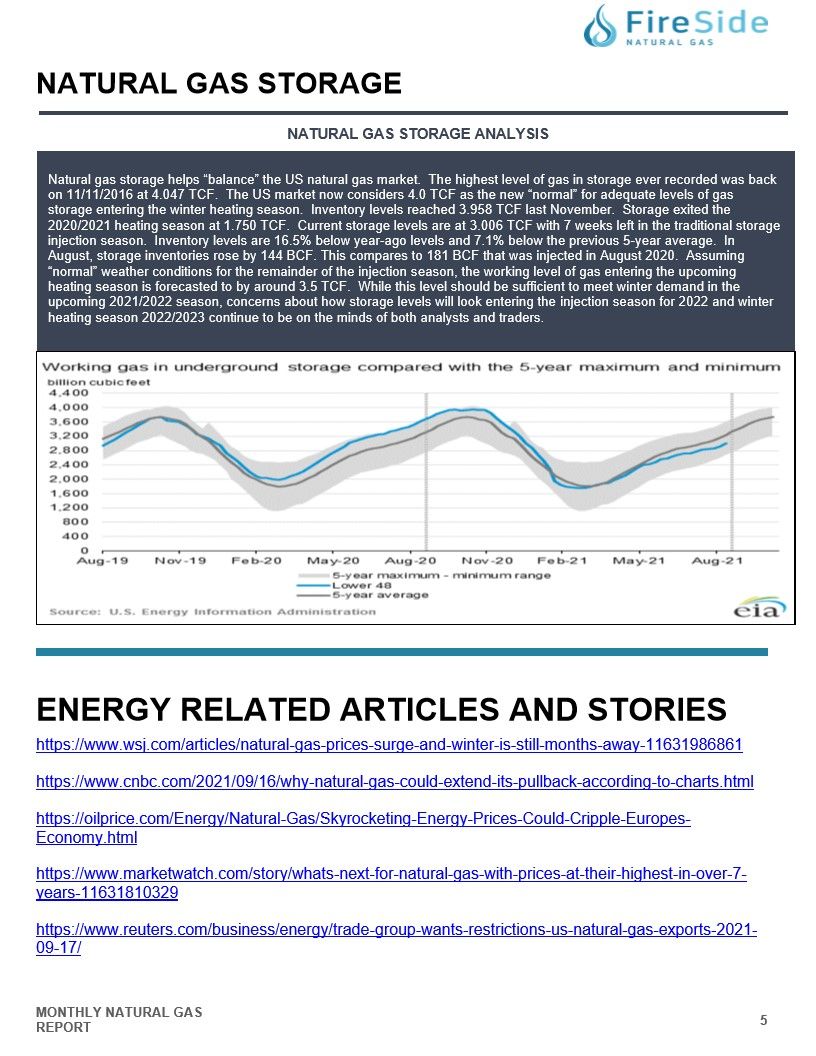

NATURAL GAS STORAGE ANALYSIS

Natural gas storage helps "balance" the US natural gas market. The highest level of gas in storage ever recorded was back

on 11/11/2016 at 4.047 TCF. The US market now considers 4.0 TCF as the new "normal" for adequate levels of gas

storage entering the winter heating season. Inventory levels reached 3.958 TCF last November. Storage exited the

2020/2021 heating season at 1.750 TCF. Current storage levels are at 3.006 TCF with 7 weeks left in the traditional storage

injection season. Inventory levels are 16.5% below year-ago levels and 7.1% below the previous 5-year average. In

August, storage inventories rose by 144 BCF. This compares to 181 BCF that was injected in August 2020. Assuming

"normal" weather conditions for the remainder of the injection season, the working level of gas entering the upcoming

heating season is forecasted to by around 3.5 TCF. While this level should be sufficient to meet winter demand in the

upcoming 2021/2022 season, concerns about how storage levels will look entering the injection season for 2022 and winter

heating season 2022/2023 continue to be on the minds of both analysts and traders.

ENERGY RELATED ARTICLES AND STORIES

https://www.wsj.com/articles/natural-gas-prices-surge-and-winter-is-still-months-away-11631986861

https://www.cnbc.com/2021/09/16/why-natural-gas-could-extend-its-pullback-according-to-charts.html

https://oilprice.com/Energy/Natural-Gas/Skyrocketing-Energy-Prices-Could-Cripple-EuropesEconomy.html