The Weekly Natural Gas Market Newsletter September 13, 2021

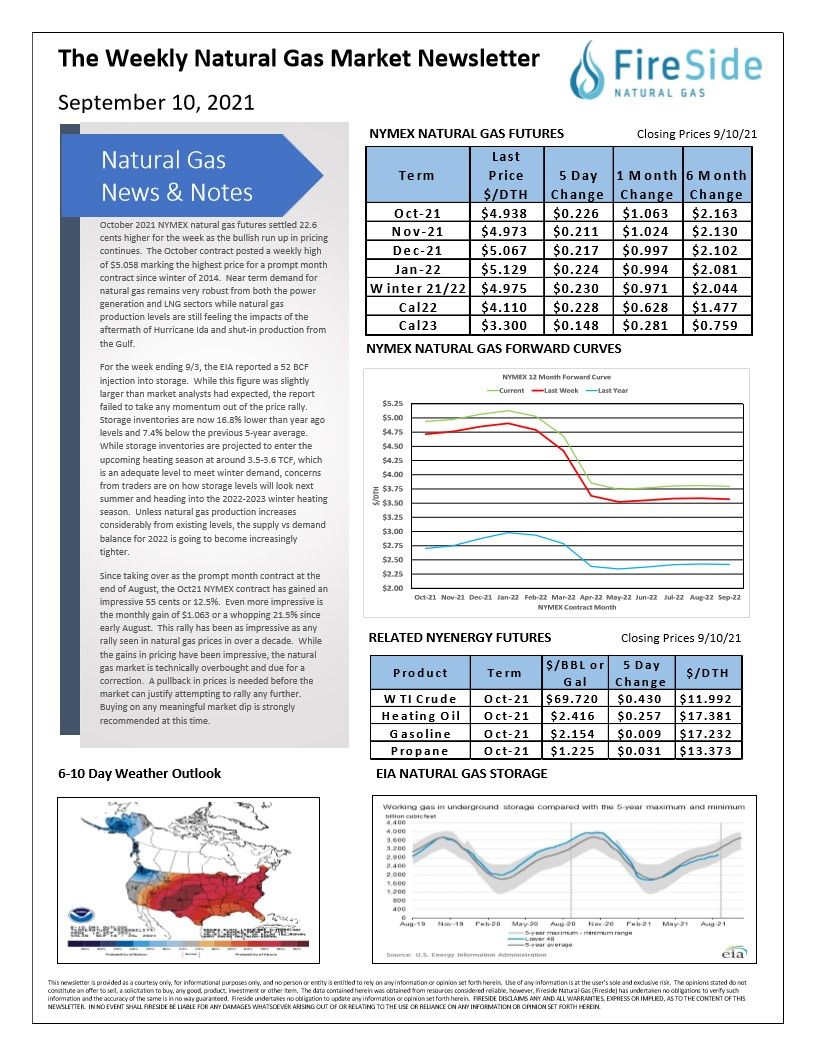

October 2021 NYMEX natural gas futures settled 22.6 cents higher for the week as the bullish run up in pricing continues. The October contract posted a weekly high of $5.058 marking the highest price for a prompt month contract since winter of 2014. Near term demand for natural gas remains very robust from both the power generation and LNG sectors while natural gas production levels are still feeling the impacts of the aftermath of Hurricane Ida and shut-in production from the Gulf.

For the week ending 9/3, the EIA reported a 52 BCF injection into storage. While this figure was slightly larger than market analysts had expected, the report failed to take any momentum out of the price rally. Storage inventories are now 16.8% lower than year ago levels and 7.4% below the previous 5-year average. While storage inventories are projected to enter the upcoming heating season at around 3.5-3.6 TCF, which is an adequate level to meet winter demand, concerns from traders are on how storage levels will look next summer and heading into the 2022-2023 winter heating season. Unless natural gas production increases considerably from existing levels, the supply vs demand balance for 2022 is going to become increasingly tighter.

Since taking over as the prompt month contract at the

end of August, the Oct21 NYMEX contract has gained an

impressive 55 cents or 12.5%. Even more impressive is

the monthly gain of $1.063 or a whopping 21.5% since

early August. This rally has been as impressive as any

rally seen in natural gas prices in over a decade. While

the gains in pricing have been impressive, the natural

gas market is technically overbought and due for a

correction. A pullback in prices is needed before the

market can justify attempting to rally any further.

Buying on any meaningful market dip is strongly

recommended at this time.