The Weekly Natural Gas Market Newsletter October 17, 2022

The Weekly Natural Gas Market Newsletter

October 17, 2022

Natural Gas News & Notes

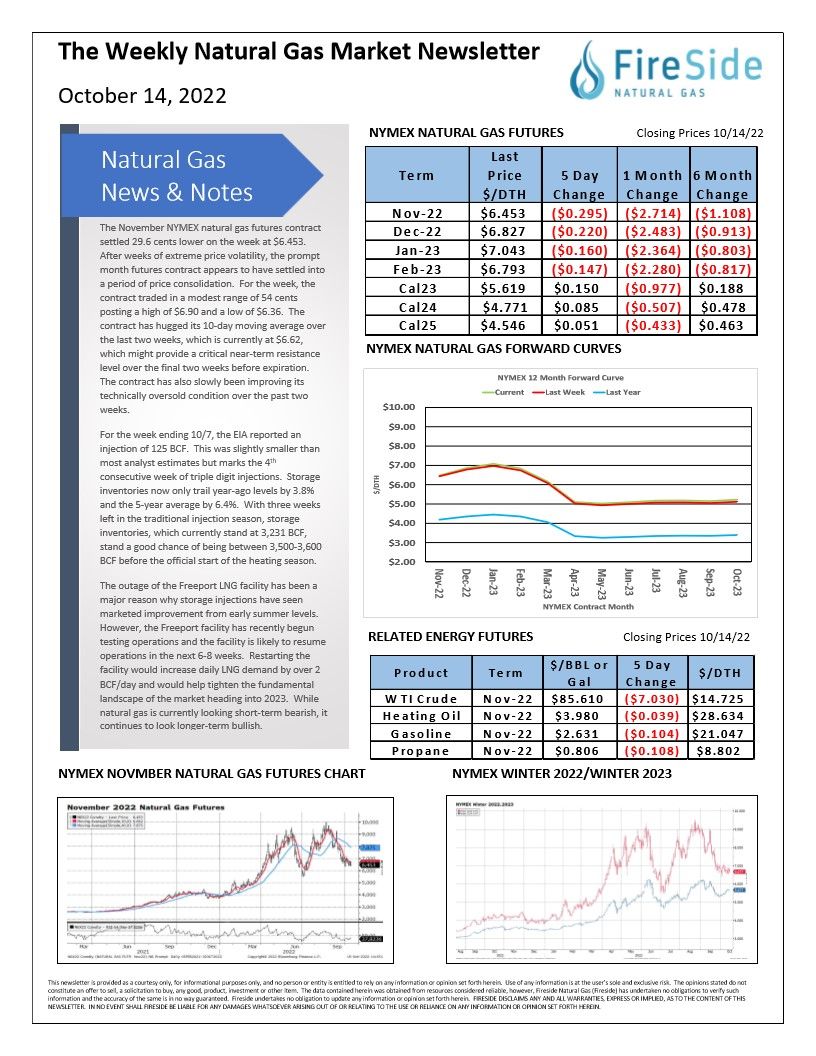

The November NYMEX natural gas futures contract settled 29.6 cents lower on the week at $6.453. After weeks of extreme price volatility, the prompt month futures contract appears to have settled into a period of price consolidation. For the week, the contract traded in a modest range of 54 cents posting a high of $6.90 and a low of $6.36. The contract has hugged its 10-day moving average over the last two weeks, which is currently at $6.62, which might provide a critical near-term resistance level over the final two weeks before expiration. The contract has also slowly been improving its technically oversold condition over the past two weeks.

For the week ending 10/7, the EIA reported an injection of 125 BCF. This was slightly smaller than most analyst estimates but marks the 4th consecutive week of triple digit injections. Storage inventories now only trail year-ago levels by 3.8% and the 5-year average by 6.4%. With three weeks left in the traditional injection season, storage inventories, which currently stand at 3,231 BCF, stand a good chance of being between 3,500-3,600 BCF before the official start of the heating season.

The outage of the Freeport LNG facility has been a

major reason why storage injections have seen

marketed improvement from early summer levels.

However, the Freeport facility has recently begun

testing operations and the facility is likely to resume

operations in the next 6-8 weeks. Restarting the

facility would increase daily LNG demand by over 2

BCF/day and would help tighten the fundamental

landscape of the market heading into 2023. While

natural gas is currently looking short-term bearish, it

continues to look longer-term bullish.