The Weekly Natural Gas Market Newsletter October 11, 2021

The Weekly Natural Gas Market Newsletter

October 11, 2021

Natural Gas News & Notes

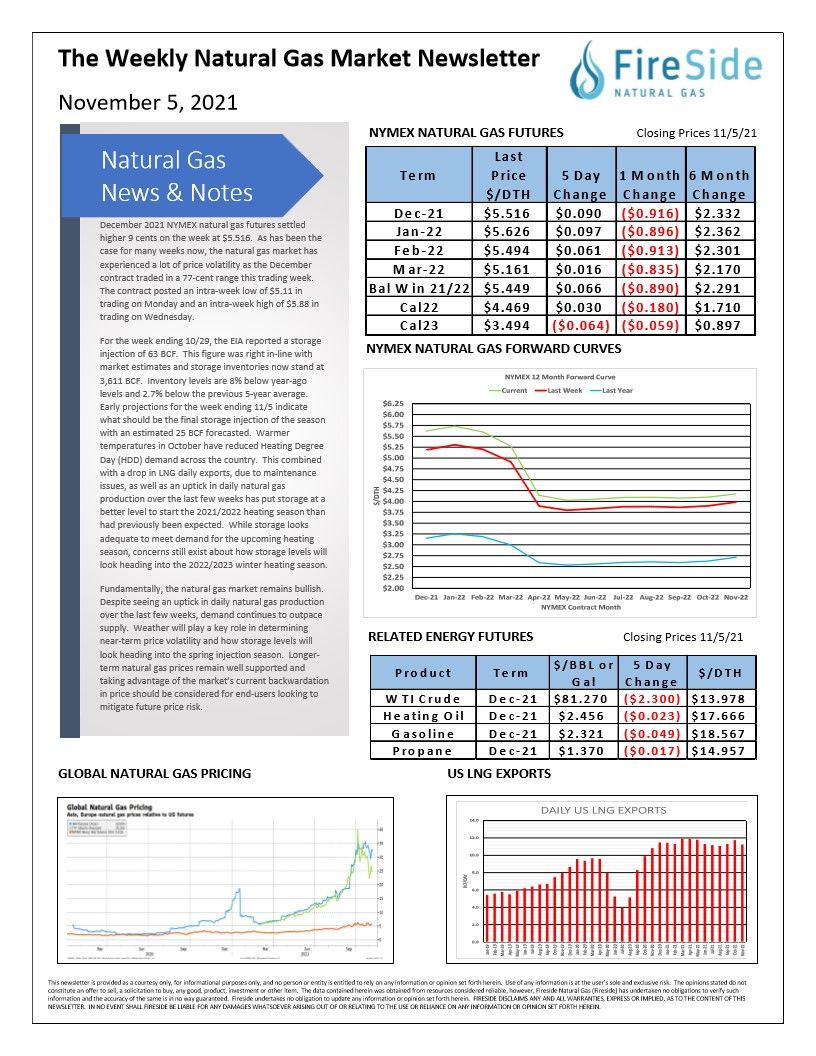

November 2021 NYMEX natural gas futures settled lower for the week by 5.4 cents. The now prompt NYMEX contract experienced yet another week of price volatility. The contract opened the week trading at $5.63 and shot to a high of $6.47 by Wednesday morning. The contract ran into some technical resistance and was unable to trade through this level. This prompted a dramatic sell-off that saw the contract loose over a $1 in value enroute to a weekly low of $5.39 by Thursday morning before rebounding slightly into the weekly close on Friday.

For the week ending 10/1, the EIA reported an injection of 118 BCF into storage. This was slightly larger than most analysts' expectations of a 115 BCF injection. Storage inventories now stand at 3,288 BCF which is 13.9% below year-ago levels and 5.1% lower than the previous 5-year average. Storage inventories are still on pace to end the traditional injection season near 3.5-3.6 TCF. This level of storage is adequate to meet heating demand this winter but concerns about the ability to inject enough gas into storage next year for the 2022/2023 heating season will be a major topic of discussion in 2022.

It's been a long time since natural gas futures have

experienced "dollar" sized price movements during the

course of a trading week. As the market inches towards

winter and with the backdrop of a bullish fundamental

picture with demand for natural gas out-pacing supply,

the potential for even larger price swings could be

expected. Natural gas is a commodity that speculators

love to trade. The commodity had fallen out of favor

with the spec trade based on the overwhelming bearish

sentiment that pummeled prices in recent years.

However, today's market landscape is vastly different

and natural gas prices are poised to both increase in

price and volatility in the coming months.