The Weekly Natural Gas Market Newsletter January 18, 2022

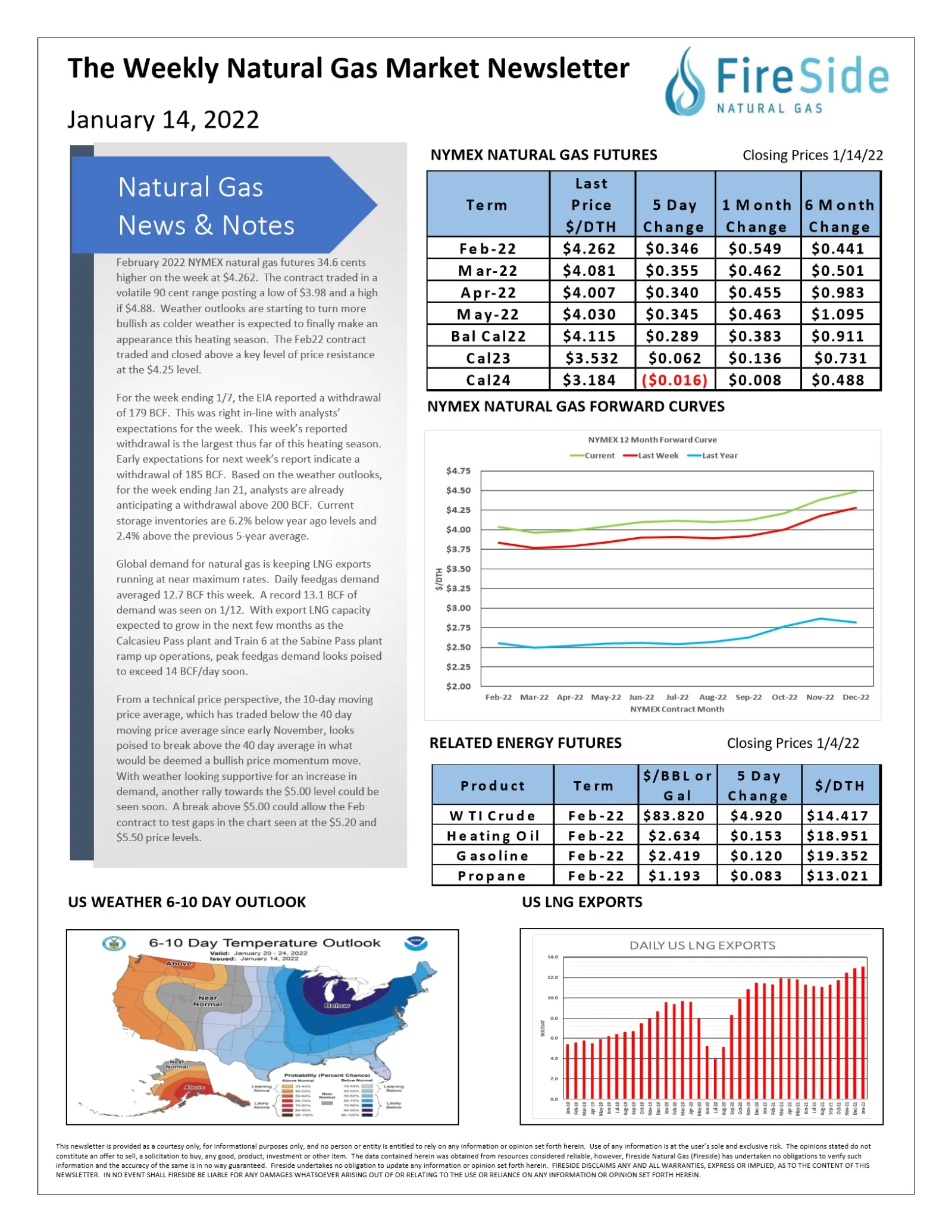

February 2022 NYMEX natural gas futures 34.6 cents higher on the week at $4.262. The contract traded in a volatile 90 cent range posting a low of $3.98 and a high if $4.88. Weather outlooks are starting to turn more bullish as colder weather is expected to finally make an appearance this heating season. The Feb22 contract traded and closed above a key level of price resistance at the $4.25 level.

For the week ending 1/7, the EIA reported a withdrawal of 179 BCF. This was right in-line with analysts' expectations for the week. This week's reported withdrawal is the largest thus far of this heating season. Early expectations for next week's report indicate a withdrawal of 185 BCF. Based on the weather outlooks, for the week ending Jan 21, analysts are already anticipating a withdrawal above 200 BCF. Current storage inventories are 6.2% below year ago levels and 2.4% above the previous 5-year average.

Global demand for natural gas is keeping LNG exports running at near maximum rates. Daily feedgas demand averaged 12.7 BCF this week. A record 13.1 BCF of demand was seen on 1/12. With export LNG capacity expected to grow in the next few months as the Calcasieu Pass plant and Train 6 at the Sabine Pass plant ramp up operations, peak feedgas demand looks poised to exceed 14 BCF/day soon.

From a technical price perspective, the 10-day moving

price average, which has traded below the 40-day

moving price average since early November, looks

poised to break above the 40-day average in what

would be deemed a bullish price momentum move.

With weather looking supportive for an increase in

demand, another rally towards the $5.00 level could be

seen soon. A break above $5.00 could allow the Feb

contract to test gaps in the chart seen at the $5.20 and

$5.50 price levels.