The Weekly Natural Gas Market Newsletter January 17, 2023

The Weekly Natural Gas Market Newsletter

January 17, 2023

Natural Gas News & Notes

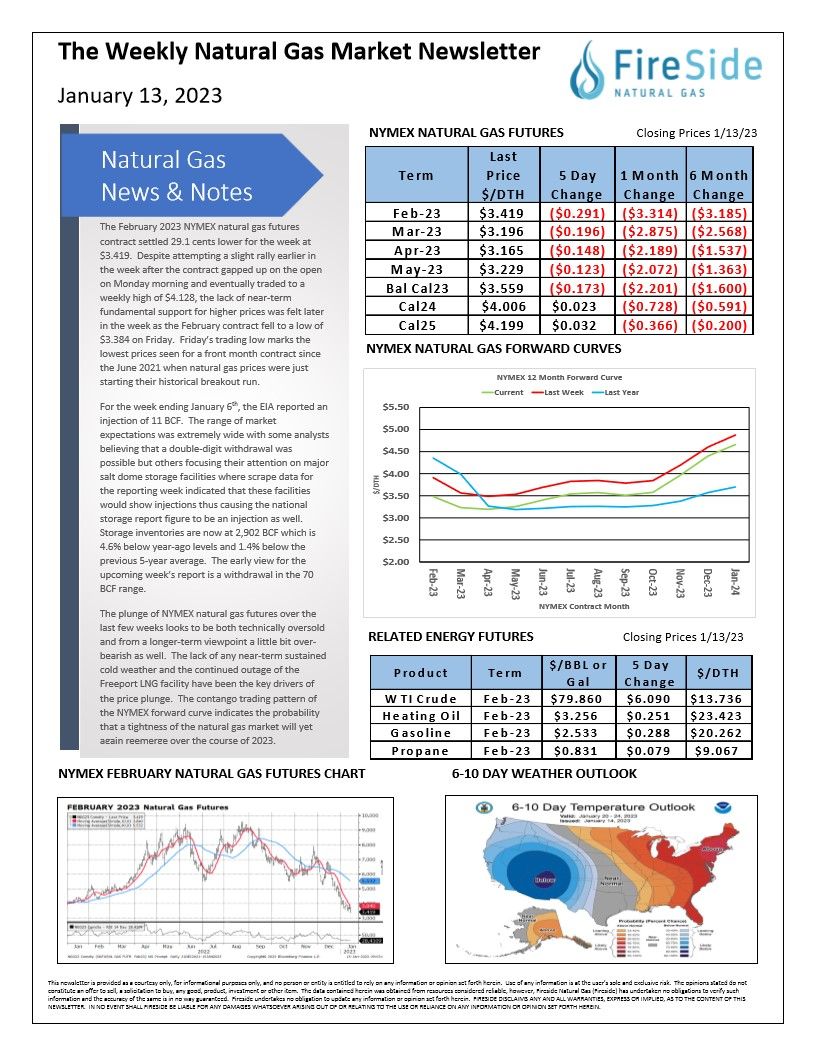

The February 2023 NYMEX natural gas futures contract settled 29.1 cents lower for the week at $3.419. Despite attempting a slight rally earlier in the week after the contract gapped up on the open on Monday morning and eventually traded to a weekly high of $4.128, the lack of near‐term fundamental support for higher prices was felt later in the week as the February contract fell to a low of $3.384 on Friday. Friday's trading low marks the lowest prices seen for a front month contract since the June 2021 when natural gas prices were just starting their historical breakout run.

For the week ending January 6th, the EIA reported an injection of 11 BCF. The range of market expectations was extremely wide with some analysts believing that a double‐digit withdrawal was possible but others focusing their attention on major salt dome storage facilities where scrape data for the reporting week indicated that these facilities would show injections thus causing the national storage report figure to be an injection as well. Storage inventories are now at 2,902 BCF which is 4.6% below year‐ago levels and 1.4% below the previous 5‐year average. The early view for the upcoming week's report is a withdrawal in the 70 BCF range.

The plunge of NYMEX natural gas futures over the

last few weeks looks to be both technically oversold

and from a longer‐term viewpoint a little bit over‐

bearish as well. The lack of any near‐term sustained

cold weather and the continued outage of the

Freeport LNG facility have been the key drivers of

the price plunge. The contango trading pattern of

the NYMEX forward curve indicates the probability

that a tightness of the natural gas market will yet

again reemerge over the course of 2023.