The Weekly Natural Gas Market Newsletter February 7, 2022

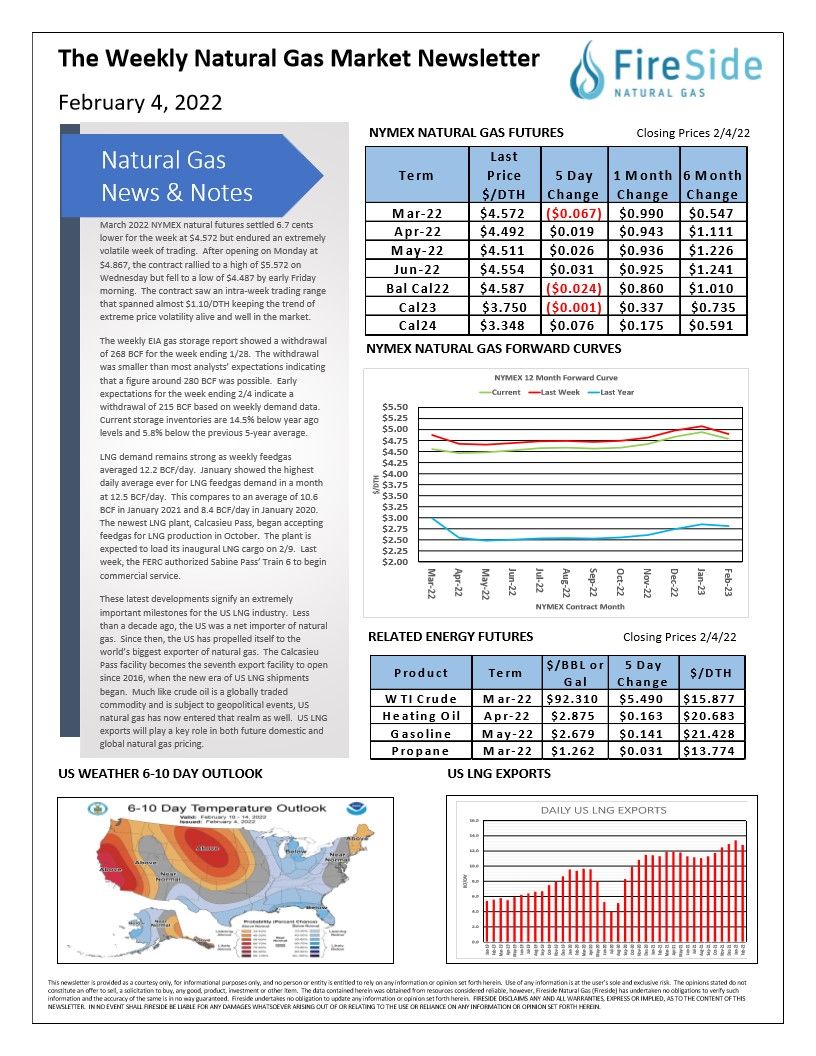

March 2022 NYMEX natural futures settled 6.7 cents lower for the week at $4.572 but endured an extremely volatile week of trading. After opening on Monday at $4.867, the contract rallied to a high of $5.572 on Wednesday but fell to a low of $4.487 by early Friday morning. The contract saw an intra-week trading range that spanned almost $1.10/DTH keeping the trend of extreme price volatility alive and well in the market.

The weekly EIA gas storage report showed a withdrawal of 268 BCF for the week ending 1/28. The withdrawal was smaller than most analysts' expectations indicating that a figure around 280 BCF was possible. Early expectations for the week ending 2/4 indicate a withdrawal of 215 BCF based on weekly demand data. Current storage inventories are 14.5% below year ago levels and 5.8% below the previous 5-year average.

LNG demand remains strong as weekly feedgas averaged 12.2 BCF/day. January showed the highest daily average ever for LNG feedgas demand in a month at 12.5 BCF/day. This compares to an average of 10.6 BCF in January 2021 and 8.4 BCF/day in January 2020. The newest LNG plant, Calcasieu Pass, began accepting feedgas for LNG production in October. The plant is expected to load its inaugural LNG cargo on 2/9. Last week, the FERC authorized Sabine Pass' Train 6 to begin commercial service.

These latest developments signify an extremely

important milestones for the US LNG industry. Less

than a decade ago, the US was a net importer of natural

gas. Since then, the US has propelled itself to the

world's biggest exporter of natural gas. The Calcasieu

Pass facility becomes the seventh export facility to open

since 2016, when the new era of US LNG shipments

began. Much like crude oil is a globally traded

commodity and is subject to geopolitical events, US

natural gas has now entered that realm as well. US LNG

exports will play a key role in both future domestic and

global natural gas pricing.