The Monthly Natural Gas Market Newsletter - February Report

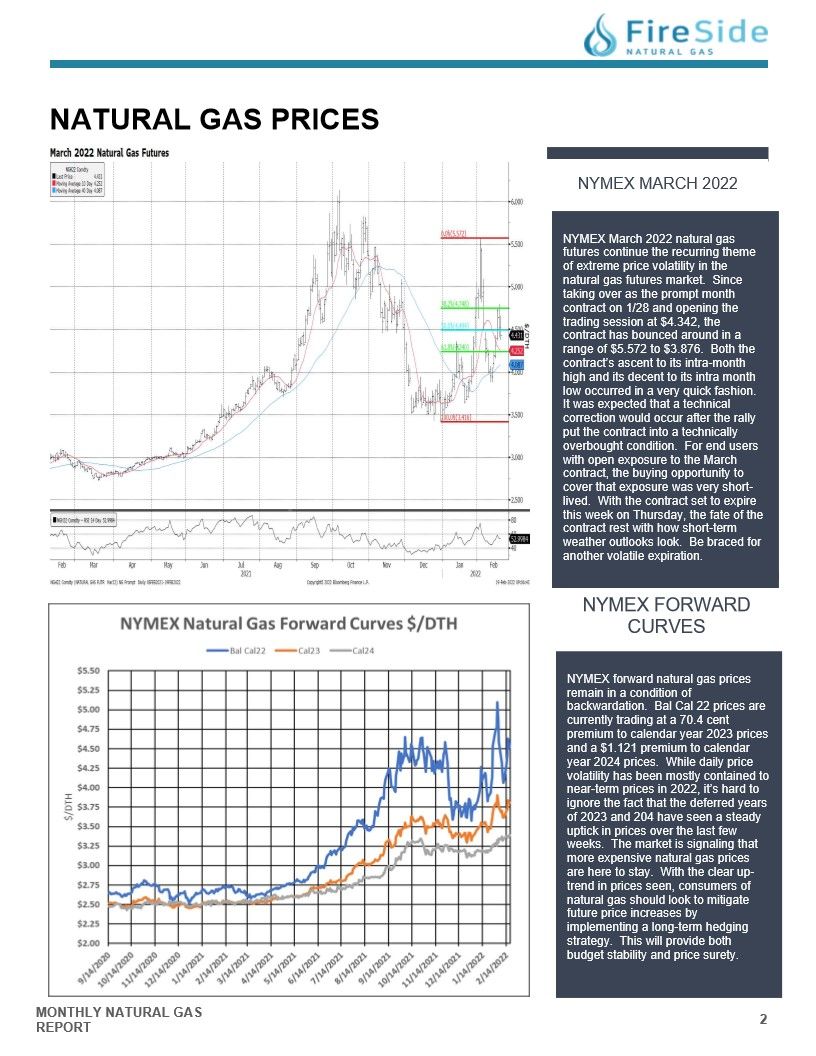

NYMEX March 2022

NYMEX March 2022 natural gas

futures continue the recurring theme

of extreme price volatility in the

natural gas futures market. Since

taking over as the prompt month

contract on 1/28 and opening the

trading session at $4.342, the

contract has bounced around in a

range of $5.572 to $3.876. Both the

contract's ascent to its intra-month

high and its decent to its intra month

low occurred in a very quick fashion.

It was expected that a technical

correction would occur after the rally

put the contract into a technically

overbought condition. For end users

with open exposure to the March

contract, the buying opportunity to

cover that exposure was very shortlived. With the contract set to expire

this week on Thursday, the fate of the

contract rest with how short-term

weather outlooks look. Be braced for

another volatile expiration.

NYMEX FORWARD CURVES

NYMEX forward natural gas prices

remain in a condition of

backwardation. Bal Cal 22 prices are

currently trading at a 70.4 cent

premium to calendar year 2023 prices

and a $1.121 premium to calendar

year 2024 prices. While daily price

volatility has been mostly contained to

near-term prices in 2022, it's hard to

ignore the fact that the deferred years

of 2023 and 204 have seen a steady

uptick in prices over the last few

weeks. The market is signaling that

more expensive natural gas prices

are here to stay. With the clear uptrend in prices seen, consumers of

natural gas should look to mitigate

future price increases by

implementing a long-term hedging

strategy. This will provide both

budget stability and price surety.

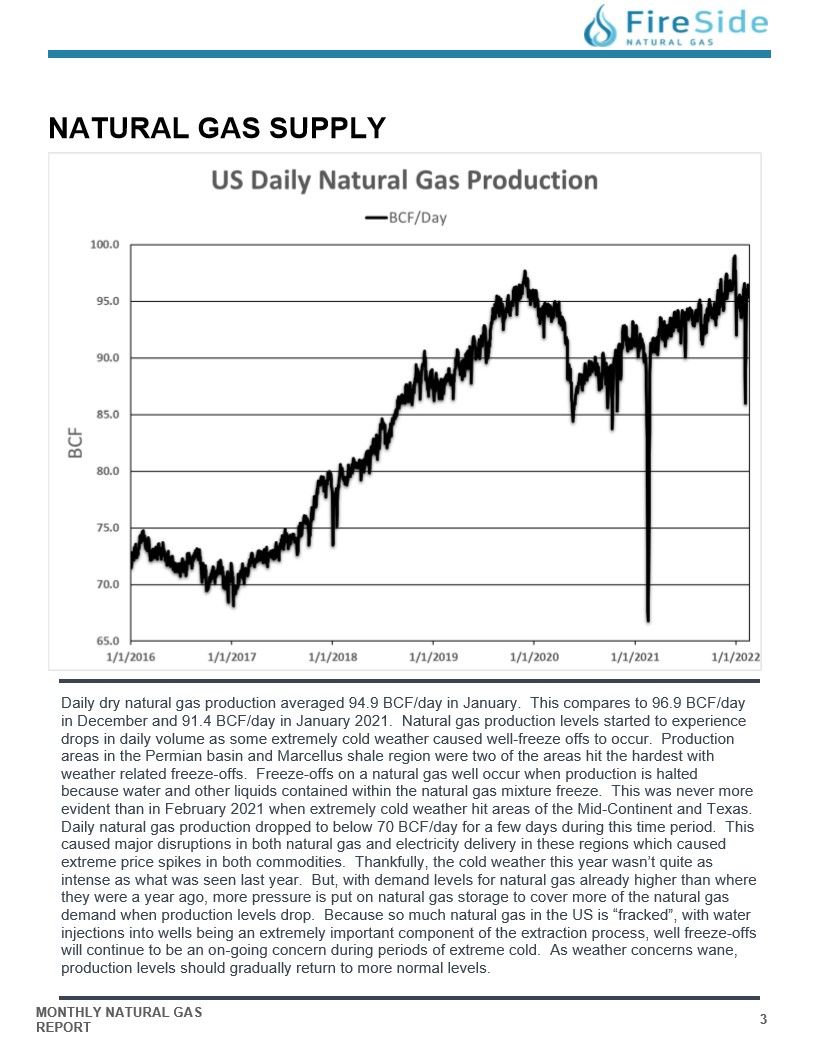

NATURAL GAS SUPPLY - US PRODUCTION

Daily dry natural gas production averaged 94.9 BCF/day in January. This compares to 96.9 BCF/day

in December and 91.4 BCF/day in January 2021. Natural gas production levels started to experience

drops in daily volume as some extremely cold weather caused well-freeze offs to occur. Production

areas in the Permian basin and Marcellus shale region were two of the areas hit the hardest with

weather related freeze-offs. Freeze-offs on a natural gas well occur when production is halted

because water and other liquids contained within the natural gas mixture freeze. This was never more

evident than in February 2021 when extremely cold weather hit areas of the Mid-Continent and Texas.

Daily natural gas production dropped to below 70 BCF/day for a few days during this time period. This

caused major disruptions in both natural gas and electricity delivery in these regions which caused

extreme price spikes in both commodities. Thankfully, the cold weather this year wasn't quite as

intense as what was seen last year. But, with demand levels for natural gas already higher than where

they were a year ago, more pressure is put on natural gas storage to cover more of the natural gas

demand when production levels drop. Because so much natural gas in the US is "fracked", with water

injections into wells being an extremely important component of the extraction process, well freeze-offs

will continue to be an on-going concern during periods of extreme cold. As weather concerns wane,

production levels should gradually return to more normal levels.

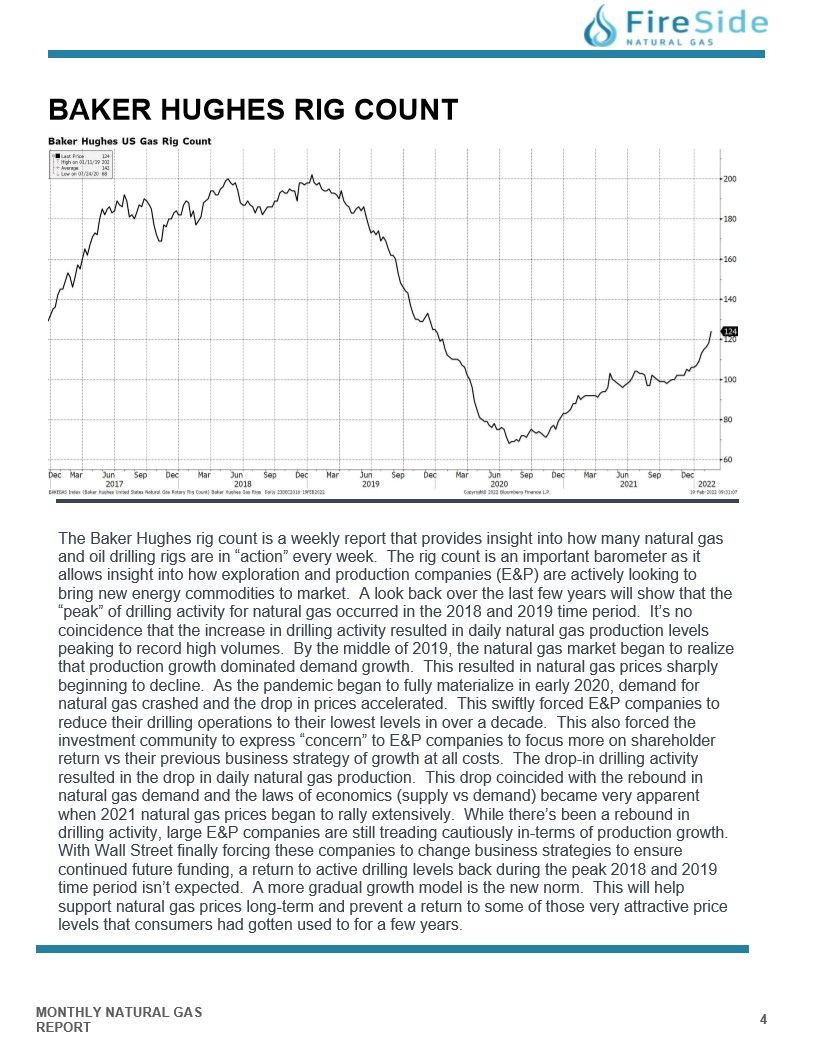

BAKER HUGHES RIG COUNT

The Baker Hughes rig count is a weekly report that provides insight into how many natural gas

and oil drilling rigs are in "action" every week. The rig count is an important barometer as it

allows insight into how exploration and production companies (E&P) are actively looking to

bring new energy commodities to market. A look back over the last few years will show that the

"peak" of drilling activity for natural gas occurred in the 2018 and 2019 time period. It's no

coincidence that the increase in drilling activity resulted in daily natural gas production levels

peaking to record high volumes. By the middle of 2019, the natural gas market began to realize

that production growth dominated demand growth. This resulted in natural gas prices sharply

beginning to decline. As the pandemic began to fully materialize in early 2020, demand for

natural gas crashed and the drop in prices accelerated. This swiftly forced E&P companies to

reduce their drilling operations to their lowest levels in over a decade. This also forced the

investment community to express "concern" to E&P companies to focus more on shareholder

return vs their previous business strategy of growth at all costs. The drop-in drilling activity

resulted in the drop in daily natural gas production. This drop coincided with the rebound in

natural gas demand and the laws of economics (supply vs demand) became very apparent

when 2021 natural gas prices began to rally extensively. While there's been a rebound in

drilling activity, large E&P companies are still treading cautiously in-terms of production growth.

With Wall Street finally forcing these companies to change business strategies to ensure

continued future funding, a return to active drilling levels back during the peak 2018 and 2019

time period isn't expected. A more gradual growth model is the new norm. This will help

support natural gas prices long-term and prevent a return to some of those very attractive price

levels that consumers had gotten used to for a few years.

NATURAL GAS STORAGE - STORAGE ANALYSIS

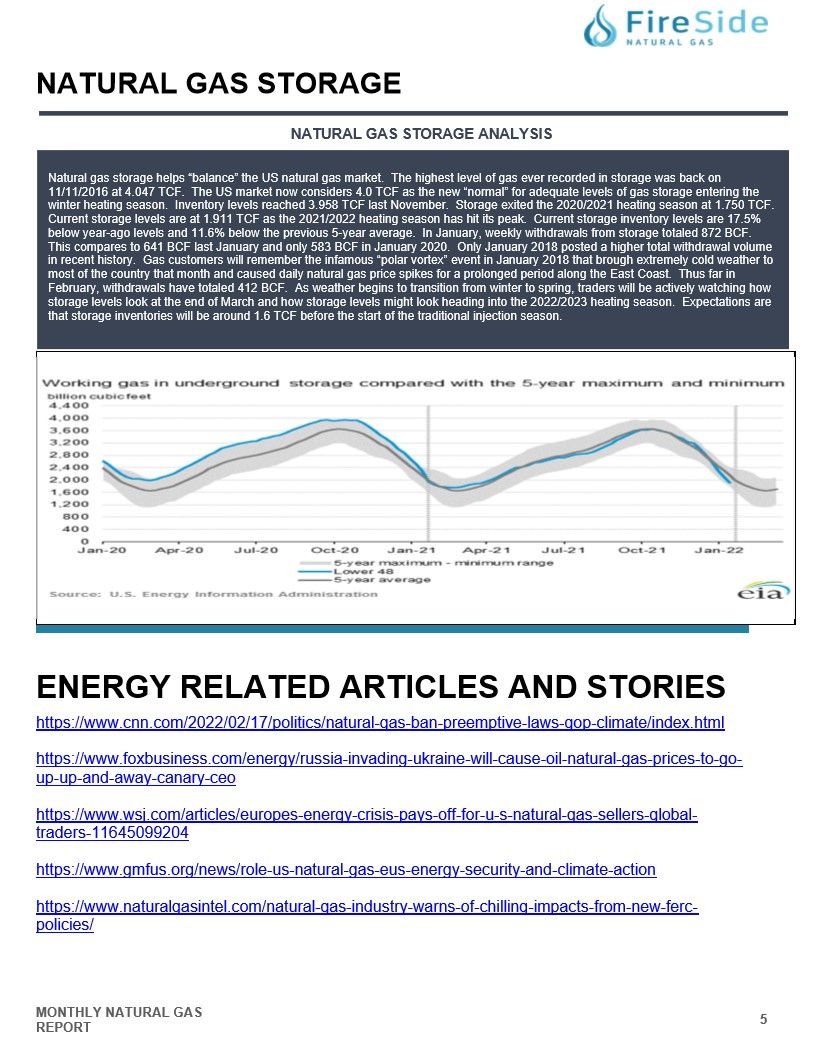

Natural gas storage helps "balance" the US natural gas market. The highest level of gas ever recorded in storage was back on 11/11/2016 at 4.047 TCF. The US market now considers 4.0 TCF as the new "normal" for adequate levels of gas storage entering the winter heating season. Inventory levels reached 3.958 TCF last November. Storage exited the 2020/2021 heating season at 1.750 TCF. Current storage levels are at 1.911 TCF as the 2021/2022 heating season has hit its peak. Current storage inventory levels are 17.5% below year-ago levels and 11.6% below the previous 5-year average. In January, weekly withdrawals from storage totaled 872 BCF. This compares to 641 BCF last January and only 583 BCF in January 2020. Only January 2018 posted a higher total withdrawal volume in recent history. Gas customers will remember the infamous "polar vortex" event in January 2018 that brough extremely cold weather to most of the country that month and caused daily natural gas price spikes for a prolonged period along the East Coast. Thus far in February, withdrawals have totaled 412 BCF. As weather begins to transition from winter to spring, traders will be actively watching how storage levels look at the end of March and how storage levels might look heading into the 2022/2023 heating season. Expectations are that storage inventories will be around 1.6 TCF before the start of the traditional injection season.

Energy Related Articles and Stories

https://www.cnn.com/2022/02/17/politics/natural-gas-ban-preemptive-laws-gop-climate/index.html

https://www.gmfus.org/news/role-us-natural-gas-eus-energy-security-and-climate-action